3 Sports stocks to invest in right now

These stock investments for the sports junkie are ones to keep an eye on in the near future

The Sports industry is big business. An attempt to compound the sports industry into various sectors would be a massive effort on its own due to complexities within the industry.

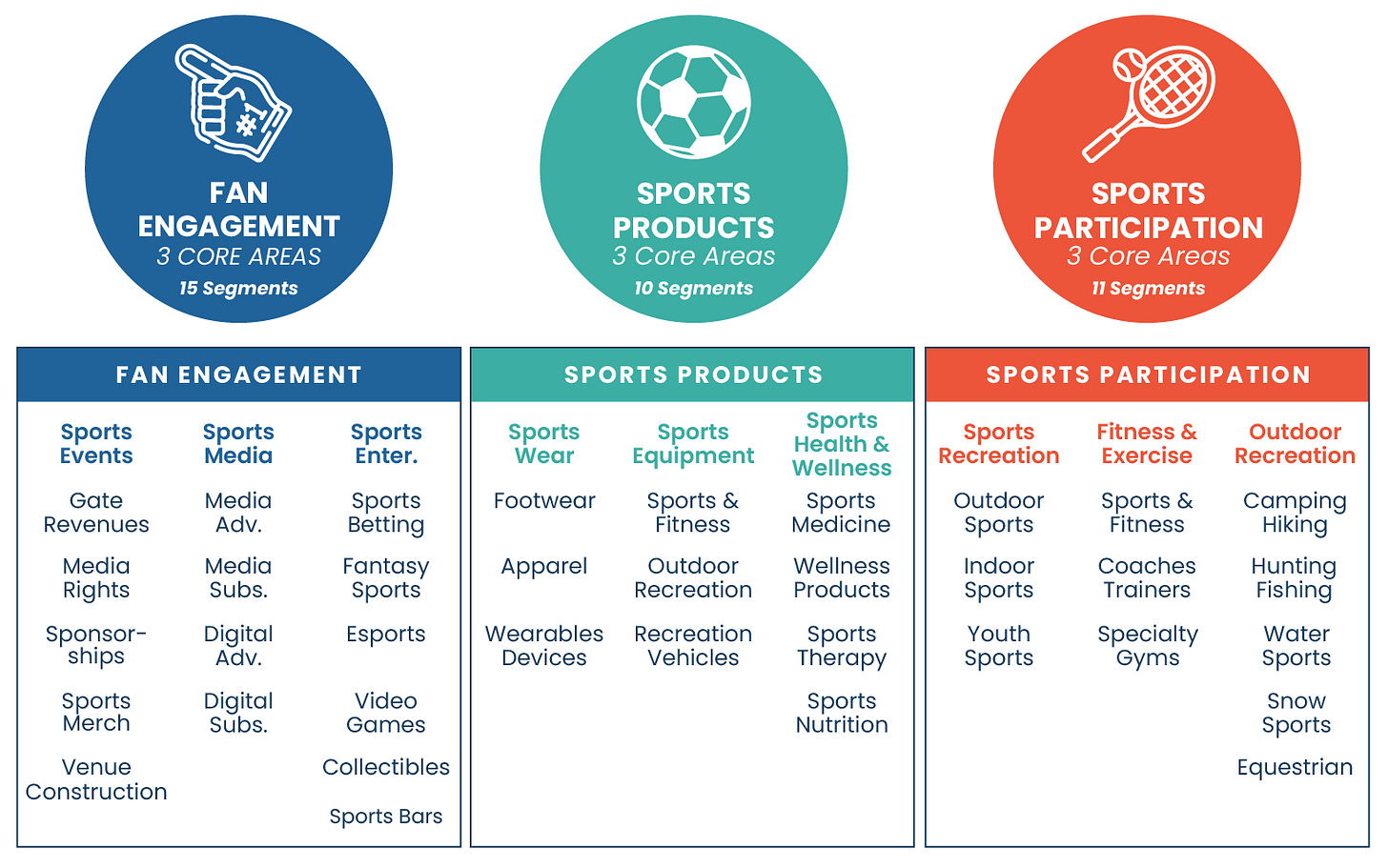

The Best-Howard model- a well defined structure that measures revenue based on more than 250,000 sports industry data points- was able to aggregate the industry into three core areas: Fan engagement, Sports products, and Sports participation.

Based on the Best-Howard’s findings- the global sports industry is estimated to be worth 2.3 trillion dollars. That’s right, Trillion.

With such a massive scope of sectors in the global sports industry, many companies want to stand out by not only attracting fans and customers, but they also want to be maintain and attract potential investors in order to capitalize off such a huge market.

One of the ways for sports companies to maintain their attractiveness in the long-run is to have public stock for purchase. Stocks allow companies to raise capital and allows investors to buy and sell shares of ownership in publicly traded companies as a benefit to their pockets.

The stock market is a complexity on its own. Companies are bought and sold, investors and companies have many federal laws they have to abide by, and the stock market plays a huge role in todays economy.

But what sports related companies are the most fun to be a part of and the most attractive to invest in?

You don’t need a lot of money to purchase a stock in sports. Some stocks are as affordable as a Grande coffee from Starbucks, and others need a bit of savings before the average person can purchase a stock to hold.

With that being said, here are the top 3 sport stocks to invest in- based on personal preference:

Endeavor Group Holdings is my #1 for obvious reasons. One of the best pieces of advice I’ve ever received is to invest in something you actually use. For example, if you eat at Chipotle a lot, invest in Chipotle. If you use Uber to get rides everywhere, invest in Uber.

The same rule applies for Endeavor Group Holdings. Per Yahoo Finance, Endeavor Group Holdings' EPS catapulted from USD $0.48 to USD $1.19 over the last year. The total year-on-year growth was 148%, which is an insane leap for one year. And it’s no surprise Endeavor had saw massive growth in its stock- in April 2023, Endeavor announced the UFC and WWE would form a $21+ Billion Global Live Sports and Entertainment Company. At the time of the announcement, Both the UFC and WWE are huge companies on their own, and the merge with Endeavor shows massive potential of growth and sustainability.

Endeavor is predicted to grow earnings and revenue by 27.2% and 7.7% per annum respectively. And the return on equity is forecast to be 18.3% in 3 years.

This doesn’t surprise the fans of the WWE and UFC, both companies have increased in popularity the past year and they don’t seem to be slowing down anytime soon. As someone who watches the WWE on a weekly basis, placing a small amount of my money into EDR is something I don’t mind doing.

Another stock investment to keep an eye out for is Churchill Downs (No, it’s not just a popular Jack Harlow feat. Drake song). Founded in 1875, Churchill Downs, Inc. operates as a provider of horse racing, online account wagering on horse racing and casino gaming. It operates through the following business segments: Racing, Casino, Online Wagering, Corporate, and Other Investments, per tradingview.com.

Although Churchill Downs is best known for being where the Kentucky Derby is held annually, that is not the primary money-maker for this company. Bloomberg reported that casino and racing machines make up the growth share of their profit mix.

Stifel analyst Jeffrey Stantial initiated coverage of Churchill Downs with a Buy rating and $148 price target. Stantial says Churchill is one of the best growth stories across gaming, reflecting a “best-in-class pipeline” of high return on investment expansion projects.

Liberty Media Group - who owns Formula 1 (and also SiriusXM)- is another favorite stock to keep an eye out on. Liberty acquired Formula 1 a little less than a decade ago for $300+ million dollars, and the sport has grown significantly in popularity since that timeframe. Most notably, Formula 1 hosted the Las Vegas Grand Prix. As of June 2024, Formula One Group (FWONK) has an enterprise value of $28.40 billion and a market cap of $16.72 billion.

In April 2024, Liberty Media purchased MotoGP rightsholder Dorna Sports in a $1.4 billion dollar deal. With many critics saying MotoGP struggled in the marketing department, the same boat Formula 1 was once in, perhaps the acquisition of MotoGP will be a good investment for Liberty to increase popularity in the sport.

Also worth noting- 2024 will be the year Formula 1 hosts the most races in one fiscal year, and 2023 had record-breaking attendance and saw an increase of fans of the sport. Also, rumors began to swirl in 2023 that Apple is preparing a $2 billion dollar bid to have global streaming rights for F1.

If you are willing to take a risk and live life in the fast lane (no pun intended), a purchase in Liberty Media Group may be the right move for you.

With all stock purchases, all investments have a risk. Since this article is solely-opinion based and I am not a licensed financial advisor, I strongly advise you to do your own research. I highly recommend you also consult with your licensed financial advisor, and invest at your own risk. In the meantime, we will be keeping an eye out for our favorite sports stocks.

If you have any sports stocks that are you favorite, comment your favorite stock below.

Another banger of a article